Resources

Steps to Start your Business in Santa Clara County

Opening a new business is a daunting task, but there is help available. Santa Clara has a well-established network of support for businesses. Not the least of which is the Enterprise Foundation. Additional resources include economic development managers in many of the cities in Santa Clara County, business assistance and industry advocacy organizations, licensing and permitting offices, workforce development strategists, venture capitalists and tax credits. The list that follows, while not exhaustive, represents a valuable guide to business support services available.

CONDUCT MARKET RESEARCH

Market research will tell you if there’s an opportunity to turn your ideas into a successful business.

Gather information about potential customers and businesses already operating in both your geographic and subject area so you can use that information to find a competitive advantage.

DEVELOP BUSINESS PLAN

Define your business goals, target market, services/products, marketing plan, and financial projections.

GET BUSINESS ASSISTANCE AND TRAINING

Take advantage of the free training and business advising services offered by Enterprise Foundation that helps you prepare your business plan, secure funding, and more.

CHOOSE A BUSINESS STRUCTURE

Decide on the legal structure (e.g., sole proprietorship, partnership, LLC, corporation).

The legal structure you choose for your business will affect your business registration requirements, how much you pay in taxes, and your personal liability. Research the pros and cons of each type for tax, liability, and operational needs. You may want to consult a lawyer or accountant for guidance.

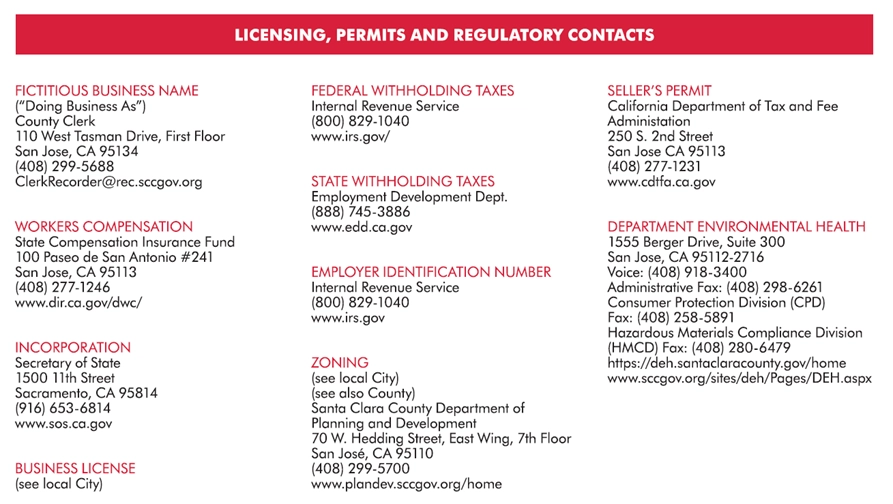

REGISTER YOUR BUSINESS

Once you’ve picked the perfect business name it’s time to make it legal and protect your brand. If you’re operating under a business name different from your personal name, you’ll need to file a Fictitious Business Name (FBN), also known as a DBA (Doing Business As), with the Santa Clara County Clerk-Recorder’s Office. (Fictitious business name statement $40).

OBTAIN NECESSARY LICENSES AND PERMITS

Business License: You need a business license from the city where your business will operate. Each city in Santa Clara County (like San Jose, Sunnyvale, etc.) has its own licensing process.

Seller Permit: A seller’s permit allows you to collect sales tax from customers and report those amounts to the state on a regular reporting period (either monthly, quarterly, or annually). There is no charge for a seller’s permit, but security deposits are sometimes required.

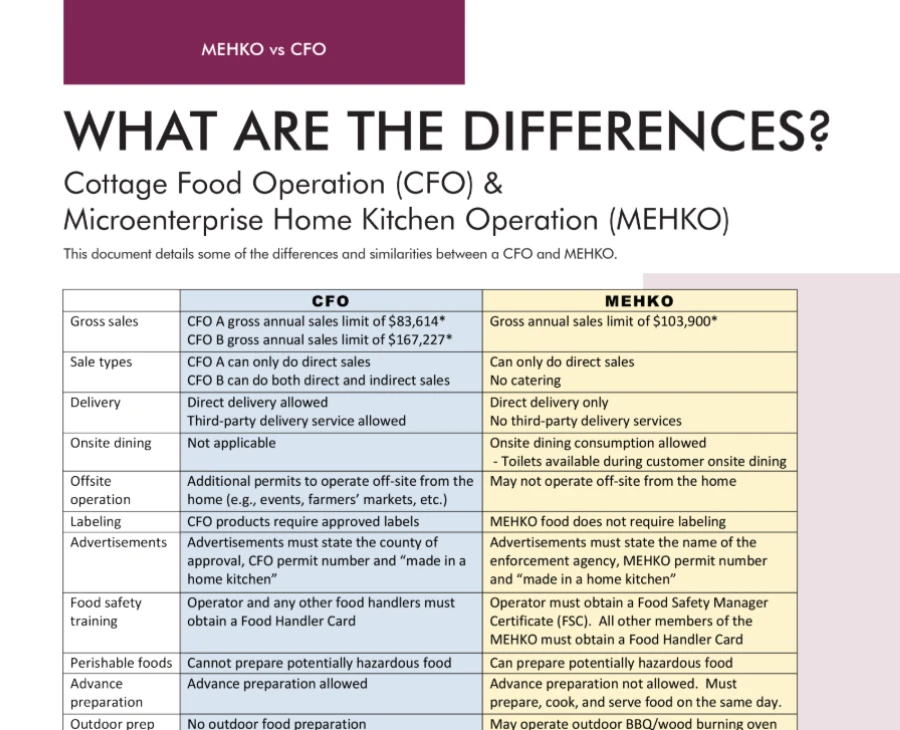

Health Permit: If you’re in the food industry, you’ll need a health permit from the Santa Clara County Department of Environmental Health.

OBTAIN AN EMPLOYER IDENTIFICATION NUMBER (EIN)

If you plan to hire employees or operate as an LLC or corporation, apply for an EIN from the IRS. Sole proprietors without employees can use their Social Security Number but may still prefer an EIN to separate business and personal accounts. Applying for an Employer Identification Number (EIN) is a free service.

DETERMINE THE IDEAL BUSINESS LOCATION

Things to keep in mind during this process include customer ease of access, proximity to competitors and local zoning regulation. Make sure you have conducted extensive market research.

UNDERSTAND EMPLOYER RESPONSIBILITIES

If you’re hiring employees, make sure you comply with labor laws, which may include:

- Workers’ compensation insurance

- Payroll taxes

Hiring practices that comply with state and federal regulations (like providing fair wages and adhering to anti-discrimination laws). Learn the legal steps you need to take to protect yourself and your business. Enterprise Foundation can provide you with training and individual counseling to ensure you understand how to hire and train your team.

SET UP YOUR BUSINESS FINANCES

Open a business bank account to separate personal and business finances. Set up accounting software or hire an accountant to manage your financial records. Consider obtaining business insurance (e.g., general liability, professional liability).

FINANCE YOUR BUSINESS

Explore funding options from small business loans and grants to investors. The Enterprise Foundation connects you to an extensive network of capital providers specializing in microbusiness loans, and our experienced advisors are here to help you, and your business become lender ready.

MARKET YOUR BUSINESS

Create a website and social media profiles to reach your target audience. Network with local businesses and community groups. Develop a marketing strategy that aligns with your business goals and budget. Enterprise Foundation has experienced business advisors that can help you through the process.

Access to Capital: Helping You Get Ready to Fund Your Dream

At the Enterprise Foundation, we know that finding the right funding can feel overwhelming—but you don’t have to do it alone. Our team works side-by-side with small business owners and entrepreneurs to get them ready for lenders, investors, and funding opportunities. With our trusted network of banks, credit unions, CDFIs, and alternative lenders, we help open doors that might have seemed closed.

Here’s how we help you prepare for success:

- Organize your finances so they tell a clear and compelling story.

- Estimate how much capital you really need to reach your break-even point and beyond.

- Improve cash flow so your business stays strong while you grow.

- Build lender-ready financial statements that show your business at its best.

- Develop financial projections that reflect your vision—and the numbers to back it up.

- Put together strong loan packages and investor pitches that get attention.

- Connect you to the right lenders or funding partners for your business goals.

Whether you’ve been turned away by banks before or you’re just starting your funding journey, we’re here to help you take the next step with confidence.